Fica tax rate calculator

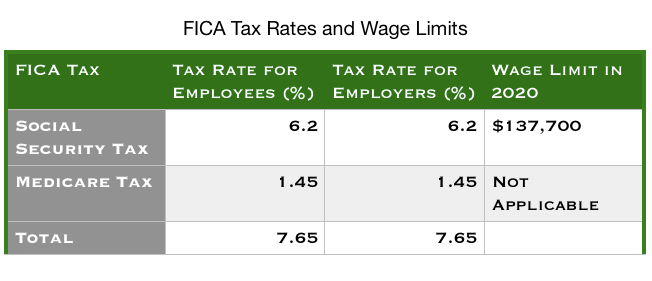

To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. And so if youre self-employed you dont have to pay FICA on all your salary just on 9235 of it 9235 being 100 minus 765 - which is the contribution that your employer would have paid if.

Social Security Tax Calculation Payroll Tax Withholdings Youtube

The current rate for.

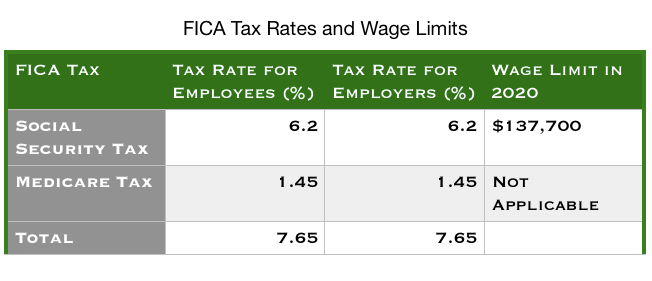

. You can get a free online fica tax calculator for your website and you dont even have to download the fica tax calculator - you can just copy and paste. Social Security and Medicare Withholding Rates. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Federal and State Tax calculator for 2022 Weekly Tax Calculations with full line by line computations to help you with your tax return in 2022. You can calculate how much youll pay for FICA taxes by multiplying your salary by 765 taking into account any exceptions or limits that might apply to your situation. Currently Texas unemployment insurance rates range from 031 to 631 with a taxable wage base of up to 9000 per employee per year.

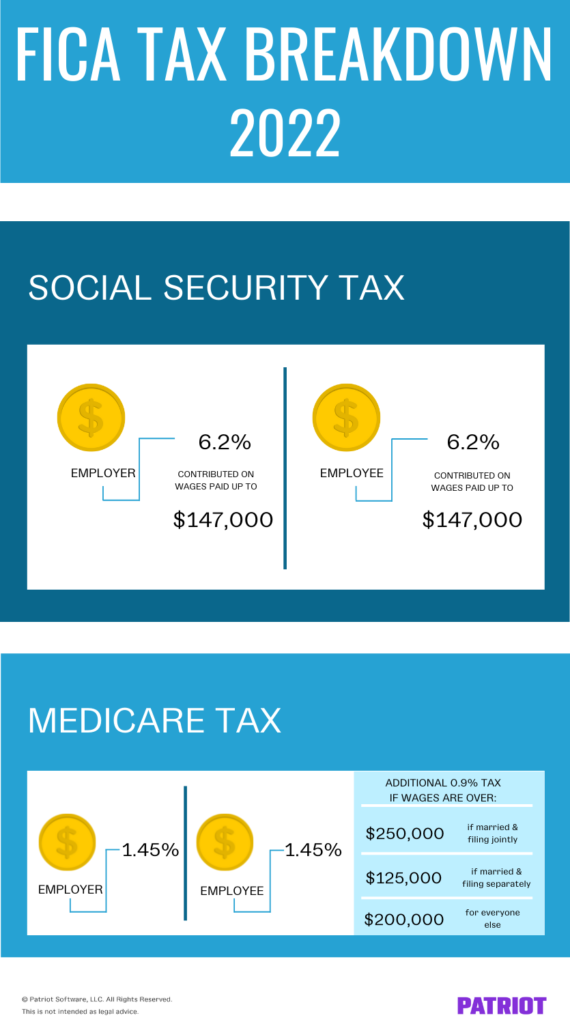

You can calculate your FICA taxes by multiplying your gross wages by the current Social Security and Medicare tax rates. There are 3 things to keep in mind when applying FICA to your payroll. FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings.

We use your income. Lets say your wages for 2022 are 135000. Deductions are a flat amount for both the employee and the employer deductions are a flat amount for.

Employee 3 has 37100 in eligible FUTA wages but FUTA applies only to the first. Since the rates are the same for employers and. The fica tax calculator exactly.

The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. New employers should use the. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

In 2022 only the first 147000 of earnings are subject to the Social Security tax. How to calculate Federal Income Tax. The maximum an employee will pay in 2022 is 911400.

A 09 Medicare tax may apply. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Free Income Tax Calculator - Estimate Your Taxes SmartAsset Calculate your 2019 federal state and local taxes with our free income tax calculator.

Paycheck Calculator Take Home Pay Calculator

What Is Fica Tax Contribution Rates Examples

Calculation Of Federal Employment Taxes Payroll Services

Taxable Social Security Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Social Security Tax Impact Calculator Bogleheads

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

Paycheck Calculator Take Home Pay Calculator

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

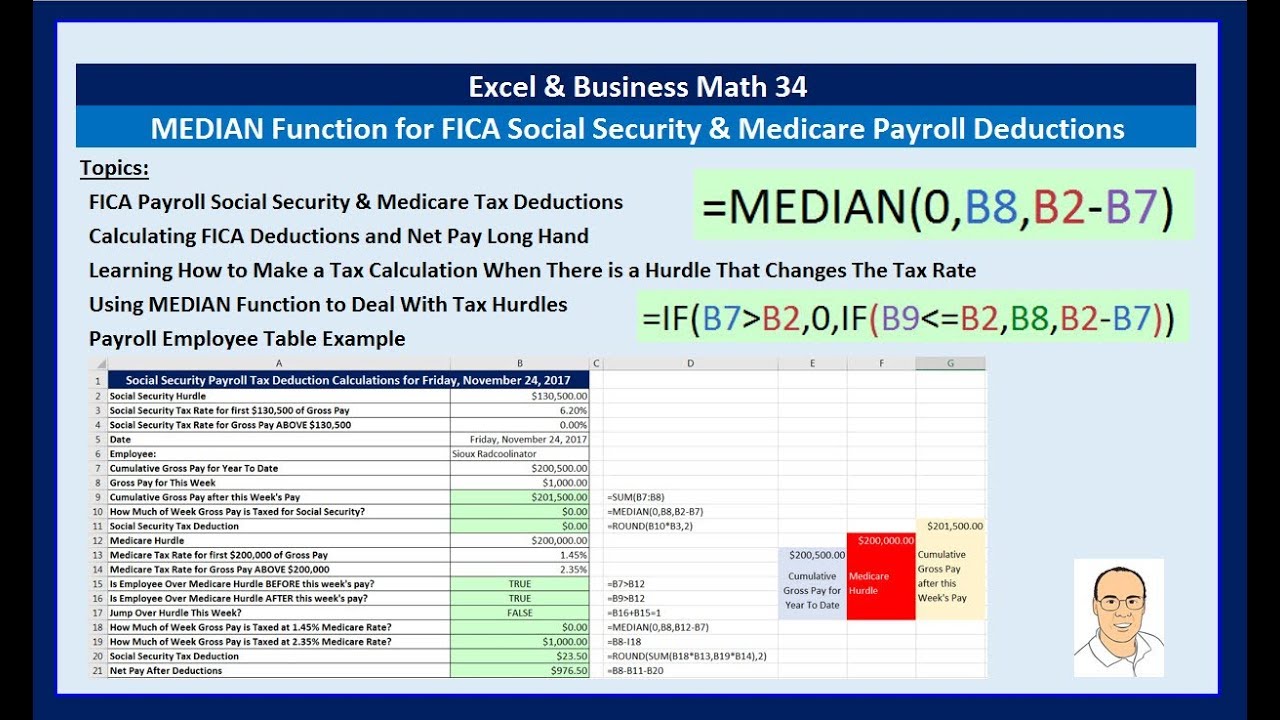

Excel Business Math 34 Median Function For Fica Social Security Medicare Payroll Deductions Youtube

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Easiest 2021 Fica Tax Calculator

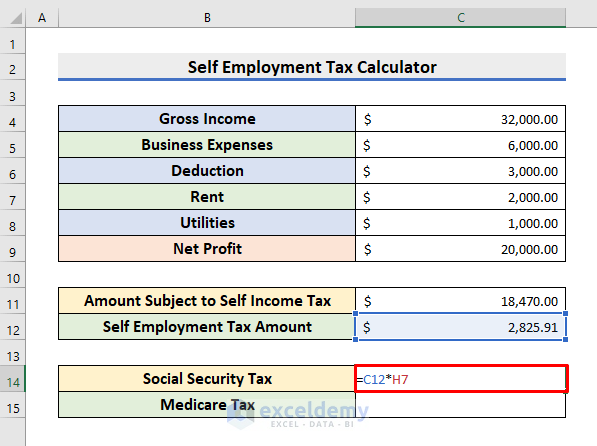

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

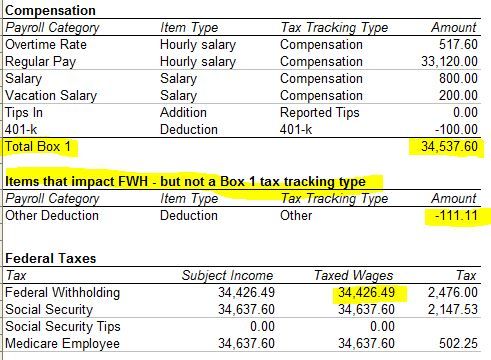

Solved W2 Box 1 Not Calculating Correctly

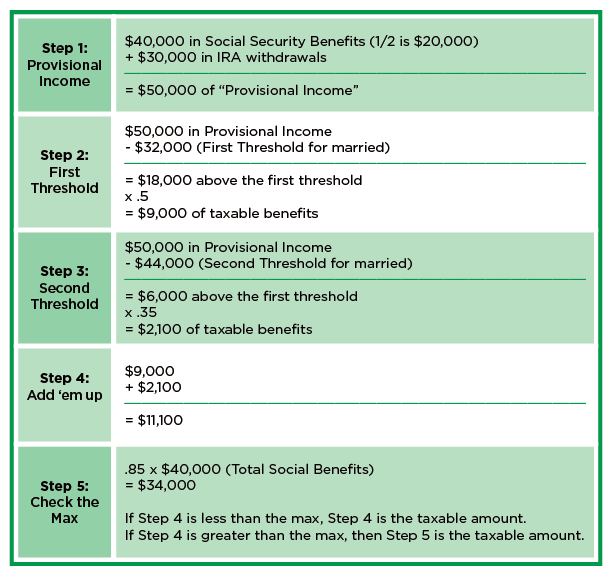

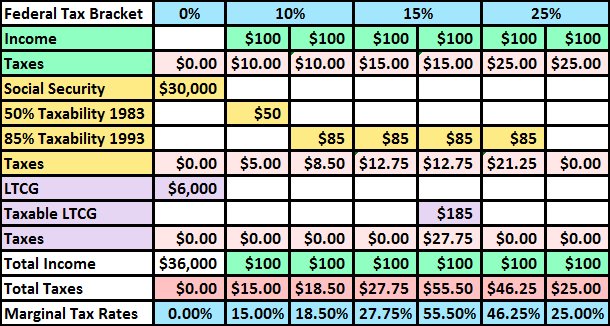

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

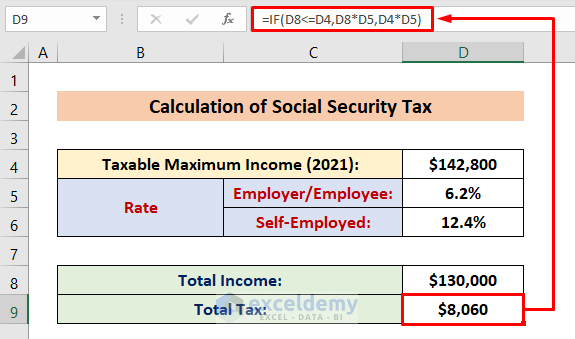

How To Calculate Social Security Tax In Excel Exceldemy